Have you ever sat looking out your office window (also known as the windshield or windscreen in your truck cab) and seen a rookie driver walk across the shipper's yard dressed in flip-flops and disheveled hair, and thought to yourself: ".. now how do you figure that image will present to the shipping clerk on the other side?"

Appearances are everything. It pays to prepare yourself to meet your customer. Whether you're a truck driver, a one truck operation, mega-fleet operation, dispatcher or back-office staffer. In the trucking business, it is especially more important because the sale doesn't end when you pick up the load, it begins when you pick it up -or at the very least: your sales relationship starts there.

Owner-operators and small truck-business owners have to compete with the multi-million dollar trucking outfits with scores of back office personnel, marketing teams, dispatchers, etc. You have a tight budget, so your best bet is to compete and excel at the nuances of marketing that don't cost a lot of money -like personality, good manners, appearance, courtesy, etc. Even a smile on your face, and body language can create or leave a good first impression on your customer. It pays to be nice to the people who make it happen. (It's good on your heart too!)

The Tools

The following is a short list of tools that I found useful in my years of trucking, and that went a long way in giving me peace of mind "..down the open road".

There are many more tools to discuss, but we'll leave that for another day.

Spiritual Strength

Every person needs something they believe in. The statement may be very subjective, but it reflects my thoughts (and views) on personal transcendence -a higher calling, and service to others. Whether you profess a christian faith, or islam, or budhist, or any religion, -you could benefit from being at peace in your mind about your beliefs and what drives you forward.

Family

Maintaining good relations with family and friends may contribute to a sense of well-being and let you focus on your business activities. It may also work to your advantage to have your family help you take care of the things you cannot attend to while you're on the road away from home. For me, I found my wife to be a great resource in planning and keeping track of important activities that needed to be done. She also took care of the business mail that arrived while I was away.

Relationships can get very stressful especially when conducted on a long-distance basis as is the case with most truck drivers and owner-operators, so making sure that loose ends are tied and you have a solid family support system will work very well for you. Remember that negative energy from broken relationships can draw tremendous amounts of energy that would otherwise be focused on your business. Take care of those loose ends in your relationships and start experiencing a new positive energy within you -definitely good for business.

Laptop

Now some more exciting stuff..

You need a good, solid reliable laptop computer to manage your business with. In this day and age, pencil and paper are no longer good enough to manage a business as complex as trucking.

As of this writing, a reliable laptop computer configured for business use will cost between $500 and $1000. Essential things to have on your laptop are:

- Wi-Fi (wireless) internet capability

- Long battery life, or extra battery

- Well padded laptop bag for storage. Laptops are very susceptible to shock and vibration, and no warranty covers defects caused by shock and vibration. You certainly want peace of mind that your data will not be corrupted from a broken hard-drive.

- A bright, glare resistant screen. The screen size does not matter, just choose one that you feel comfortable with and that won't cause you to strain your eyes while using it. Most laptops come with screen sizes of between 15" - 17". The larger the screen, the more pricey the laptop. Personally, a 15.4" wide screen works very well for me.

Other essentials for your laptop would include the accessories that help you work better, like a laser/optical mouse, mouse pad, USB headset/microphone if you use VOIP telephony services (e.g. Skype, Google Voice, etc.)

Printer/Scanner

This is a must-have item in your truck. It is necessary for you to be able to scan all your shipping paperwork, print directions, pre-plans from your dispatcher, print faxes received online, etc.

Printing business papers or faxing at the truck-stops and travel centers is very expensive. It costs between $2 and $5 per transaction and these charges can easily add up to a significant amount every month. Remember that keeping your operating costs in check will save you money and improve the overall bottom line for your business.

These days, most shippers and brokers accept electronic copies of documents for proof of delivery (POD) or billing purposes. Electronic transmission of paperwork also guarantees that you won't lose paperwork in the mail, and let's you keep the original documents for your records. By sending documents electronically, you are also able to maintain the same electronic copies for easy reference or remote retrieval.

Hi-Speed/Wi-Fi Internet Access

This is how you stay connected to the business world online.

A High-speed internet connection plan will let you manage your business better by allowing you access to online load-boards, shipper/customer databases, online faxing, or even real-time access to your business tools and data as is possible with Trip Sheet Central (TSC).

Choose a plan that does not limit you to a certain usage per month because overage charges can get very expensive.

A good plan these days costs between $50 and $90 a month -a small price for a business to stay on the cutting edge and compete on the same level with other companies using sophisticated technology platforms.

Cell Phone

Communication by cellphone is still the top method drivers use to do business with the home terminal/office, shippers/receivers, brokers, and stay in touch with family and friends. A cellphone can also be used to communicate emergency information or get directions if you have a GPS enabled phone.

With that said, you shouldn't have to pay premium for good service. Shop for the best carrier rates and coverage coast to coast. The last thing you want is for your cellphone to register "no-service" as soon as you lose sight of the town lights on your west-coast mirrors! I don't have a preference for which cellphone carrier to recomend, but I would go with one that is available nationwide, includes long-distance, does not charge roaming charges and the service can be possibly bundled with high speed internet service.

Business Website/Email

A website presence opens opportunities to tell business partners and customers all about your company. It provides an inexpensive marketing avenue for your services. Almost gone are the days when you had to print brochures and pamphlets about your business and mail them to a limited geographic area.

At the earliest opportunity in your business, you should include plans to setup a website and email addresses. At a minimum, your website should contain information on how to contact you, your location and services, and possibly ways for your customers to interact or provide feedback to you.

A professional looking website may also help you score high "first impression" points with potential customers who look you up on the web.

Additionally, be sure to add your company's website on all stationary, invoices, bills of lading, and all public and customer-facing documents. That will help put your business name upfront and center, and invite customers to learn more about your business online.

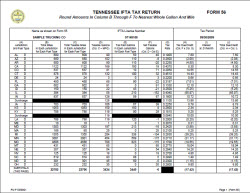

Trip Sheet Central (TSC) - A truck-business management suite

Trip Sheet Central (TSC) is a web-based truck-business management suite used to keep track of trucking business records, trip sheets, income and expenses, shippers and receivers, accounting statements and IFTA tax information. It is designed for truck owner-operators, truck fleet-owners and company drivers.

TSC analyses truck business profitability, cost-per-mile, creates real-time profit-loss statements, cash-flow, operating expense statements, invoices, driver settlement reports and many more business statements.

All your business critical information is organized in one place, and securely accessible from wherever your busy schedule takes you -on the road, at the truck-stop, in your office, at home or from any internet connected computer.

More information on what TSC can do for you is available at:

https://www.tripsheetcentral.com/

Load Boards

Over the last few years internet freight load boards have become the primary source of freight loads for many owner-operators. Load boards work by allowing brokers and shippers to post available freight, and interested parties bid for them.

Trucking companies also post available equipment and interested shippers and brokers bid to contract the equipment to haul their freight.

As a small business trucking company, using these load boards can supplement your available freight business by ensuring you do not have to run huge dead-head miles.

There is no need to subscribe to all available load boards since most shippers and brokers post freight to all boards. Choose the load board that has the features you need, like credit monitoring, performance reports, fraud prevention, payment histories on demand, etc. Internet load boards cost between $35 and $70 a month depending on options chosen.

Equipment Service Contracts

Inevitably when running high maintenance equipment like semi tractors and trailers, break-downs will occur. It's not a matter of if, it's a question of when. You need to be prepared to handle these situations so they don't turn into emergencies and show stoppers for your business.

I recommend setting up a couple of strategies:

- Service contracts or accounts with vendors who provide service nationwide and are accessible 24 hours day or night:

This is necessary to give you peace of mind that when your truck breaks down in the middle of nowhere you can obtain reliable service from vendors who are familiar with your equipment types.

A simple plan may include towing services, tires services and preventive maintenance.

Contrary to popular belief that vehicle dealerships cost more than other repair facilities, I found that maintaining active accounts with a combination of my truck manufacturer dealerships and several major truck-stop chains was actually very cost effective. If you have a small fleet you could try keeping the same type and model to reduce the number of accounts you have to maintain, and also benefit from volume discounts on parts and service.

- Equipment maintenance escrow fund:

Even with a fabulous service contract or account you still have to pay for the service. So put some money away into an escrow-like account which you can draw when needed. Use the money for maintenance costs only and replenish withdrawn funds as soon as possible.

A good amount to save is 10 cents for every mile traveled, loaded or empty, for each tractor and trailer unit. This works!

Fuel Card or Money Card

Fuel cards and money cards are a great way to keep track of trucking expenses if they have detailed reporting features that you can access online or in your monthly statement. These statements can help you meet record keeping requirements mandated by the FMCSA.

Perhaps an even bigger benefit is that your back-office support person can make funds from paid invoices available by depositing into the accounts that support your fuel/money cards. Most establishments now take debit cards, so you don't have to carry large amounts of cash.

TIP: Use your debit/fuel/money card only when you have full control or the person swiping the card is in full view during the transaction. This can help prevent identity theft from dishonest establishment employees. If you feel the financial transaction will be compromised, pay cash or avoid the establishment altogether.

Always reconcile your expenses as quickly as possible into your business-management software, preferably on a daily basis.

Credit Union or Bank Account

Take the time to open a small business banking account to simplify your record keeping and life. Shop around for the best deal. Small business banking varies in fees and features.

The costs of a business account are far less than the benefits to your business. Fees are partly tax deductible as an expense.

Keep in mind that your business may grow. Opening a business account with a bank earlier can help with required financing in the future.

Remember to run your business as a business and do not mix personal funds with business funds.

See our in-depth report on how to start a trucking business for more information.

Proper Permits and Licenses

Imagine having to stop at the port of entry for every state you travel through to obtain a trip permit for that state.

I'm thinking of long lines, long wait times, commercial vehicle inspection, driver inspection, confusing paperwork, and the list goes on.. -Urgh

Now imagine watching the green light and the single chirp on your pre-pass in-cab device, followed by the green by-pass signal from the DOT's weigh-in-motion telling you to 'keep on rollin' -Sweet!

As a truck-business owner, you could benefit greatly by obtaining all the state-specific permits in advance.

Licenses like IRP, IFTA and UCR cover 48 states in USA and 10 of the 13 Canadian provinces.

Benefits of an IFTA, IRP or UCR include

- A single fuel tax license and one set of decals that authorizes your vehicles to travel in all member jurisdictions

- A single fuel tax report that details your operations in each of the member jurisdictions

- Ability to credit the fuel tax overpayment for one jurisdiction against the tax liability for another jurisdiction, which reduces or possibly eliminates a payment

- Ability to remit one check, or receive one refund from the base jurisdiction

- Audit conducted by the auditors from your base jurisdiction, instead of potentially 58 US and Canadian jurisdictions