Starting a trucking company will require coordinating a number of processes. Federal and state registrations and permitting are required, as well as securing insurance.

The trucking business requires a special kind of person to succeed. Special in the sense that even though the basic characteristics of smart, persistent, articulate and well organized, one also requires patience, dedication and a reliable support system.

OK! Let's get started...

Business Plan

You need a plan. The same way you wouldn't begin to build a $100,000 home without a blue-print is the same approach you should take when starting your trucking business. Yes that's right - Trucking Business!

Lay out on paper everything you can think of that you'll need to do. Your plan should be guided by facts, research and professional advice from experienced people in the trucking industry.

At a minimum, your business plan should include:

- Organizational setup (company name, location, management, etc)

- Financial plan (cash flow, balance sheet, projections, etc.)

- Operating plan

- Marketing plan

- Growth plan

- Research and development

- Exit plan

Choosing a Company Name

It is very important to decide on what to call your company from the start. This name will be your company's identity and should be unique, easy to spell and pronounce, and most desirably -should be available as a web site domain name. So for instance, if you choose to call your company Quick Transport, Inc., then you should check to see whether the domain name www.quicktransport.com is available and reserve it by registering with a reputable service like PairNIC (www.pairdomains.com).

Resources

Check your States Secretary of State website for specific information about starting a business in your state.

Tax ID / Federal Employer Identification Number (FEIN)

This is an important step in setting up your business. Get this setup as soon as possible.

An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity.

This EIN is your permanent number and can be used immediately for most of your business needs, including:

- opening a bank account;

- applying for business licenses;

- filing a tax return by mail

However, no matter how you apply (phone, fax, mail, or online), it takes up to two weeks before your EIN becomes part of the IRS' permanent records.

You must wait until this occurs before you can:

- file an electronic return

- make an electronic payment

- or pass an IRS Taxpayer Identification Number matching program.

Do not pay anyone to get this for you! It is free.

Go to https://www.irs.gov/businesses/small-businesses-self-employed/employer-id-numbers and do it yourself.

Bank Account

Take the time to open a small business banking account to simplify your record keeping and life. Shop around for the best deal. Small business banking varies in fees and features.

The costs of a business account are far less than the benefits to your business. Fees are partly tax deductible as an expense.

Keep in mind that your business may grow. Opening a business account with a bank earlier can help with required financing in the future.

Remember run your business as a business and do not mix personal funds with business funds.

Apply for an USDOT number and MC number

Register your business with the U.S. Department of Transportation (USDOT). Trucking companies, commonly referred to as carriers, are regulated by the Federal Motor Carrier Safety Administration, a part of the U.S. Department of Transportation. All trucking companies are required to have a USDOT number, obtained by registering with the U.S. Department of Transportation. When you begin the registration process there are some things that you need to know about your trucking company.

Setting up Insurance

Contact an insurance company or broker that specializes in trucking companies and request a quote for insurance. They will generally require information on your vehicles, drivers, type of cargo and distance traveled (interstate, intrastate, international, for example). Proof of insurance is required for a number of permits and filings that are required to start a trucking company. However, don't secure your insurance too soon, because you will be paying for insurance that you can't use until everything else is in place! Ask your insurance agent if it is possible to have your insurance effective date about 2 weeks after you secure insurance - that will allow you some time to get all of the other paperwork done.

Apply for an IRP/License Plates

Develop your International Registration Plan, or IRP. When you license your commercial vehicle in your home based state, you have to fill out an IRP form. This form requires you to identify the U.S. states, Canadian provinces and Mexican states that you will be traveling in. This form also requires you to estimate the number of miles that will be traveled in each state. Your fee is based on the number of states and the number of miles traveled in each state.

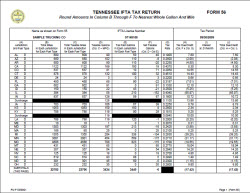

Apply for an IFTA License

The International Fuel Tax Agreement (IFTA) form is completed with basic truck and company information and submitted to the IFTA office to receive an IFTA sticker. This IFTA sticker must be placed on the vehicle. IFTA filings are required on a quarterly basis. The IFTA filing consists of documenting the number of miles driven in each state and the number of gallons purchased in each state for the quarter. You will, generally, send in a fee when you send in your quarterly IFTA filing-unless you get really bad fuel mileage! Trip Sheet Central offers IFTA fuel tax reporting at affordable rates.

Apply for your Unified Carrier Registration (UCR)

UCR is a relatively new registration. This registration allows you to carry cargo across state lines. There is a simple online process available from most state Department of Transportation websites. You may also contact your state public utilities commission office (PUCO) for the form. This form requires basic company and vehicle information.

Apply for State Specific Permit Requirements

Many states require registration or permits for carriers that will be hauling intrastate cargo or even for carriers that will cross the state line en route to another location. These states include Oregon, Texas, Kentucky, New Mexico and New York. For example, a KYU number is required for all carriers that travel in or through the state of Kentucky. This number is obtained by filling out a form and sending it into the state. They get their money when you file a quarterly report that indicates how many miles you drove in the state of Kentucky for that quarter.

Once you determine the states that you will be traveling in or through, contact the Motor Carrier office in that state. This office may operate under a different name but will generally be a part of the state department of taxation or motor vehicles.

Signage Required on Vehicle

Post the following signage on your vehicle:

- Company Name

- Home Terminal Location

- USDOT

- MC Number

- Last 8 digits of the vehicle VIN

- Truck Number

Additional information may need to be on the signage, such as your KYU number, if required. Tip: You can have vinyl signs printed for a low price at most print shops like FedEx Kinkos. Truck-stop printers are generally more expensive.

Driver Qualification Files and Other Records

This step must be complete before you can begin trucking operations of any kind. All drivers must undergo and pass a drug screen test and physical/medical exam before starting work. A medical certificate is issued after these tests, which must be carried by the driver at all times he/she is on duty. A copy of the medical certificate (card) will need to be on file at the home terminal.

- Perform a department/bureau of motor vehicles search on your driver, for all states that he/she has held a license in for the past ten (10) years. Perform this search annually.

- Perform a pre-employment check on your driver and obtain employment history for the last ten (10) years.

- Sign up for participation in a Drug/Alcohol program which will provide random and post accident drug tests.

- Create or sign up for participation in a safety program.

- Create or sign up for participation in a maintenance program (includes preventative maintenance, annual inspection and repairs).

- Create or sign up for participation in a Log auditing program.

- Create an accident register-documentation of any accidents that vehicle is involved in-regardless of who is at fault.

- Document vehicle information-VIN and gross vehicle weight.

- Document all dispatch data-listing when, for whom, where and what were shipped to whom and where.

- Document fuel purchased; listing quantity and location

Keep all the driver information above in the Driver Qualification file at the home terminal. It must be available when your trucking company is audited. All trucking companies must undergo an audit within the first eighteen months of operation.

Truck Permit Book/Dossier

The transportation industry is a heavily regulated industry. Documentation that confirms that your trucking company is properly licensed and has all the necessary permits must be available for inspection in the truck.

It is a good idea to have duplicate copies of all licenses and permits at the home terminal.

Documentation required in the truck at all times includes:

- CAB card - This record shows your current USDOT number, MC number, IRP, UCR and IFTA jurisdiction information. It is normally valid for one year and must be renewed annually. Tip: Always renew early to avoid steep fines, penalties and down-times resulting from a failed road-side or weigh-station inspection.

- Any required permits or filings for individual states will need to be carried in the vehicle as well.

- Proof of Insurance. Truck Insurance companies will normally send you a cab card insurance certificate. The actual policy will normally be mailed to the home terminal where it should be kept.

- Driver's Daily Log Books. Your driver will need to complete, on a daily basis, a driver's daily log.

- Daily Vehicle Inspection. Your driver will need to complete, on a daily basis, a vehicle inspection report. Standard driver's daily logs incorporate the vehicle inspection on the form.

- Bills of Lading. For every load picked up by the driver, the shipper will issue a bill of lading (BOL) to be delivered with the shipping. The BOL is a manifest describing the cargo being hauled, and information about the origin and destination. A copy of the BOL should be sent to the home terminal for billing and record maintenance when the truck is unloaded.